The Global World of Finance

The ‘global’ financial world as we know it today was built around an Innocence/Guilt way of thinking. Legal codes in primarily Innocence/Guilt countries tend to be extensive and extremely detailed, reflecting the cultural importance placed on knowing exactly what is right and what is wrong, particularly in matters involving banking and taxes. Every detail of a company’s finances should be documented to ensure financial transparency, and should the law appear insufficient to cover the continually evolving world of finance, it will be updated to ensure that a new standard is created.

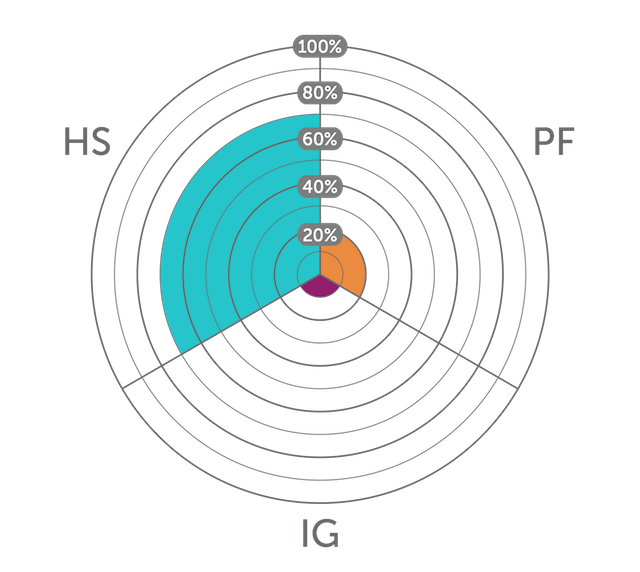

This approach to handling money however does not necessarily apply in Honor/Shame or Power/Fear environments, where people approach finance very differently.

Bookkeeping

Innocence/Guilt companies tend to see bookkeeping very differently from Honor/Shame and Power/Fear oriented companies. The purpose of bookkeeping is ultimately to communicate the finances of the business to the world in a way that either adds honor or enhances the power base of the organization.

From the point of view of the business, bookkeeping is meant to add to the honor of the family who owns the business, to add to the honor of the name of the business, to enhance the power or prestige of that business in a certain market or to add to the power base of the family or person that owns that business. Applying international financial best practice as such may not produce the results you expected, as the people to whom you are addressing your requests do not hold the same worldview.

On paper bookkeeping may be about recording financial transactions but in practice it is clearly about Honor & Power in two thirds of the world.

This is reflected in IPOs. In Africa, some parts of Asia and Latin America, IPOs can take up to three times longer to put together than they would in more Innocence/Guilt oriented countries. This is because releasing the books to the public, although legally required, may not put the cmpany in its best light. In general, when dealing with a company from a more Honor/Shame or Power/Fear oriented culture, much more time needs to be invested to get the company to a place where an IPO is actually possible.

This is also reflected by the presence or absence of bankruptcy laws. In general, in Honor/Shame oriented countries with emerging economies, bankruptcy laws tend to be among the later laws to be implemented because bankruptcy is a matter of shame, and it is very hard for people to admit financial failure in public.

How I/G Financial Firms Should Manage Companies with Different Worldviews

When financial firms deal with Honor/Shame or Power/Fear oriented companies, there needs to be a more relational approach to getting the information that the team needs. This is because there are more than just legal compliance issues to manage; the relational capital must be in place and the request should be put across appropriately.

It is unlikely that you would get the information you need by simply stating it is a legal obligation to comply with your request. For example, in an Honor/Shame oriented culture the request needs to be phrased in a way that will not threaten the honor of the person you are requesting it from, due to the sensitive nature of financial information and the fact that maintaining the honor of the individual and the company is seen as more important than strict adherence to the written law.

* Originally published on KnowledgeWorkx

- Log in to post comments